- SumUp has raised $306 million (€285 million) in combined equity and debt funding.

- The round was led by Sixth Street Growth. Bain Capital Tech Opportunities, Fin Capital, and Liquidity Capital also participated in the investment.

- The funding round does not change SumUp’s valuation which, as of June 2022, stood at $8.5 billion (€8 billion).

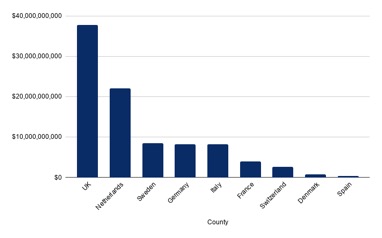

London-based fintech SumUp has secured $306 million (€285 million) in growth funding. The round was led by Sixth Street Growth and featured participation from Bain Capital Tech Opportunities, Fin Capital, and Liquidity Capital. The company will use the funding, which includes a combination of equity and debt, to support international expansion.

The round reportedly does not change the company’s most recent June 2022 valuation of $8.5 billion (€8 billion). It follows SumUp’s announcement of a $100 million credit facility from Victory Park Capital earlier this year.

In a statement, SumUp CFO Hermione McKee credited the merchants on the company’s platform – more than four million strong – for the company’s growth. “(It) is a direct result of the success of the traders we serve and would not be possible without the unwavering trust and support of the investor community,” McKee said. “This funding gives us additional firepower to pursue growth opportunities and accelerate products that empower small businesses.”

Founded in 2012, SumUp provides businesses of all sizes with affordable payment products and financial services. The company won Best of Show in its Finovate debut at FinovateEurope in 2013, and has since grown into a major payment solutions and point of sale systems provider active in 36 markets around the world. These markets include Australia, where SumUp launched in August.

More recently, the company introduced Tap to Pay on iPhone for SumUp customers in both the U.K. and the Netherlands. This enables SumUp merchants to accept all types of contactless payments using only an iPhone and the SumUp iOS app. No additional hardware is required. SumUp sees the offering as ideal for new and smaller merchants looking to potentially scale their businesses and broaden payment options for customers. SumUp Senior Strategic Growth Manager Giovanni Barbieri underscored the technology’s ability to support financial inclusion. “I am especially pleased with the exceptional functionality of the product and the fact (that) it lowers barriers to entry, with the potential to fuel entrepreneurship.”

This spring, SumUp launched its multi-product subscription offering, SumUp One. The new solution amalgamates the company’s product suite in a single, unified solution for merchants. SumUp One initially launched in Italy and the U.K.