The Reserve Bank of India (RBI) announced a number of new fintech initiatives this week. Among the more interesting was a plan to bring AI-powered, conversational payments to the country’s UPI (Unified Payments Interface) system.

The National Payments Corporation of India (NPCI) launched the platform in 2016. Today, UPI has more than 300 million monthly active users in India. There are also 500 million merchants who use the platform to accept payments. With UPI, users can link multiple bank accounts to a single mobile app, and then make real-time, P2P transactions via mobile device or smartphone. Analysts expect daily transaction volume on UPI to reach one billion by 2026-2027.

The proposal would enable users to initiate payments from within both chat and messaging apps. “As Artificial Intelligence (AI) is becoming increasingly integrated into the digital economy, conversational instructions hold immense potential in enhancing ease of use, and consequently reach, of the UPI system,” the RBI press release read. “It is, therefore, proposed to launch an innovative payment mode viz., ‘Conversational Payments’ on UPI, that will enable users to engage in a conversation with an AI-powered system to initiate and complete transactions in a safe and secure environment.”

Conversational Payments will be available initially in Hindi and English, with other Indian languages to be added. The technology will be available via smartphones and feature phone-based UPI channels, which the Reserve Bank of India believes will lead to broader adoption and further financial inclusion. To this end, the RBI has also proposed to bring Near Field Communications (NFC) technology to its UPI-Lite on-device wallet. Launched last fall, UPI-Lite is designed to facilitate small value transactions and now processes more than ten million transactions a month.

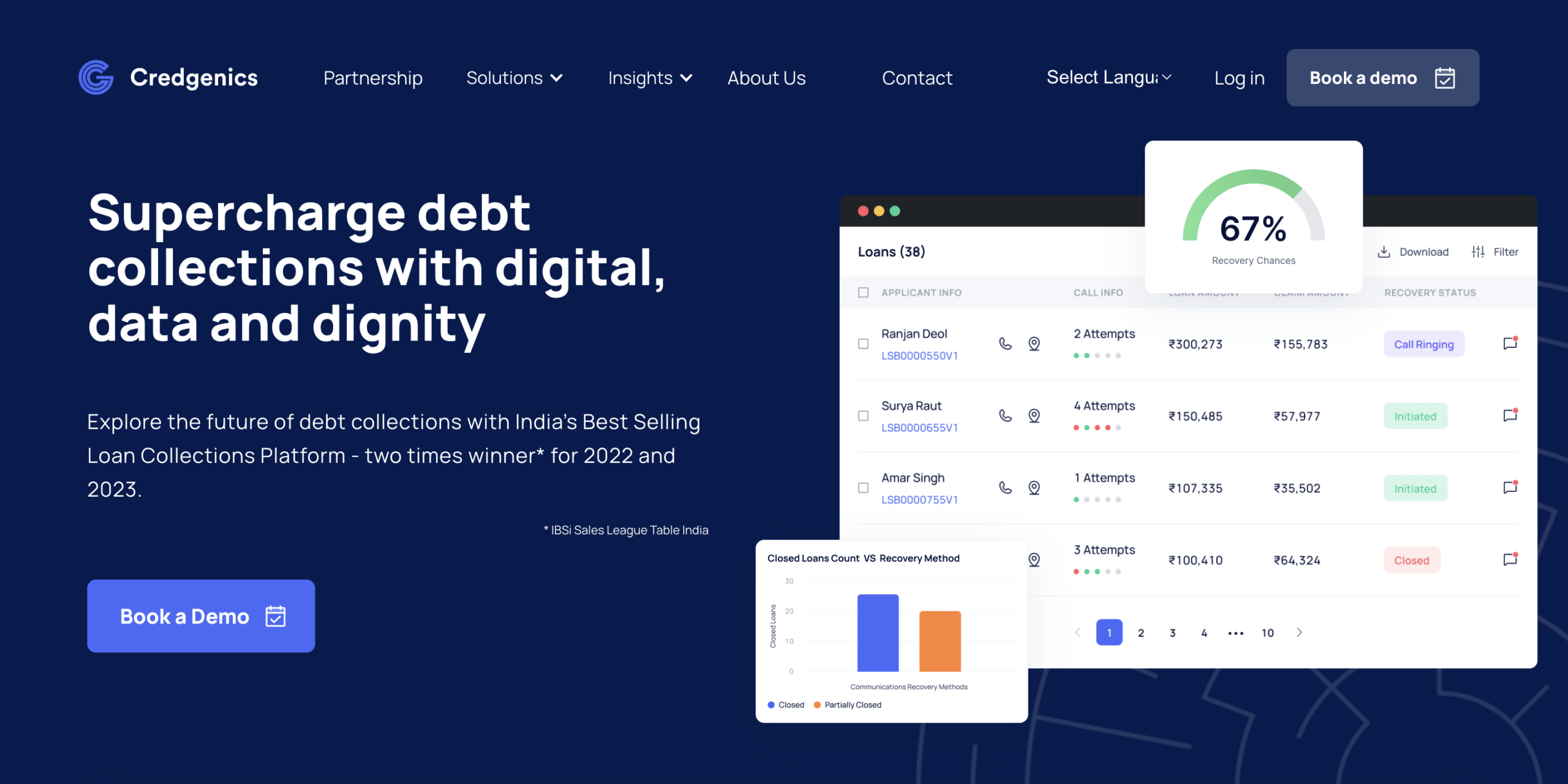

An investment of $50 million has given Indian debt collection software-as-a-service (SaaS) platform Credgenics a valuation of $340 million. Accel, Westbridge Capital, Tanglin Ventures, Beams Fintech Fund, and other strategic investors participated in the Series B round.

Company co-founder and CEO Rishabh Goel said that the capital would do more than just help the firm expand into new markets. “This funding not only accelerates our growth, but also enables us to make a meaningful impact on the economic landscape of countries, unlocking new opportunities for financial well-being,” Goel said.

Founded in 2019, Credgenics currently serves more than 100 private banks, non-bank financial companies, fintechs, and asset reconstruction companies. The company’s debt resolution platform provides a suite of solutions including digital collections, collections analytics, litigation management, agent performance management, and a field collections mobile app. The technology leverages AI-driven intelligent automation and machine learning to bring greater efficiency to the collections process.

Credgenics handles 11 million retail loan accounts and touched an overall loan book worth $60 billion in fiscal year 2023. The company became operationally profitable this spring. This summer, Credegnics announced a partnership with Indonesia-based lender Investree. The company also was recognized as the Best Selling Loan Collections Platform in IBS Intelligence India Sales League Table for the second year in a row.

There are more than 3,000 recognized fintech startups in India. And the Indian government is giving itself a gentle pat on the back for helping make that happen.

Minister of State for Corporate Affairs (independent charge) Rao Inderjit Singh provided the report to Parliament as part of the Startup India initiative. Launched by the Department for Promotion of Industry and Internal Trade in 2016, this initiative establishes the criteria that confers recognition by the Department. These factors include data of incorporation, as well as revenue and profit benchmarks.

Singh pointed to the “Fintech Entity Framework” as an example of one of the actions taken by the government – in this case the International Financial Services Centres Authority (IFSCA) – to promote the country’s fintech startup ecosystem. This framework includes a comprehensive scheme of grants for startups, sandboxes, proof-of-concepts (PoC), accelerators, and more.

Singh also credited the government for the success of an initiative which streamlined beneficiary account opening and direct benefit transfers, and improved access to multiple financial services applications. The initiative is called the Pradhan Mantri Jan Dhan Yojana (PMJDY), meaning “The Prime Minister’s Public Finance Scheme,” and it set a new world record for account openings upon its launch in 2014. This spring, the initiative reached a major milestone of more than $28 billion (₹2 lakh crore) in deposits.

Here is our look at fintech innovation around the world.

Central and Eastern Europe

- Ukrainian payment platform Fondy launched a new cashless payment service, Fondy Terminal, based on Visa Tap to Phone technology.

- Berlin-based fintech Monite introduced a new Chief of Staff, a new Chief Product Officer, and a new Head of Marketing.

- Latvian fintechs petitioned the country’s Finance Ministry and central bank for fintech regulations that reflect the industry’s “best practices”.

Middle East and Northern Africa

- Paysend teamed up with Israel-based fintech Okoora to enhance payments in Israel.

- UAE-based cryptocurrency exchange Bybit launched its new wealth management solution.

- Saudi air carrier flynas partnered with MENA-based shopping and financial services app Tabby.

Central and Southern Asia

- Indian software-as-a-service debt collection platform Credgenics raised $50 million in Series B funding.

- The Reserve Bank of India announced plans to add AI-powered conversational AI to the country’s UPI system.

- India-based Airtel Payments Bank launched a new eco-friendly debit card.

Latin America and the Caribbean

- Mexico’s DolarApp partnered with international issuer-processor Paymentology to enable commission-free dollar purchases for Mexicans.

- Binance secured cryptocurrency exchange licenses to operate in El Salvador.

- Thought Machine partnered with Chilean SME lending solutions company Cordada.

Asia-Pacific

- The central bank of Bangladesh partnered with Fime to launch its national card scheme.

- Singapore-based digital advisor Endowus secured $35 million in funding.

- Visa went live with Apple Pay in Vietnam.

Sub-Saharan Africa

- Nigerian mobility fintech Moove raised $76 million in combined equity and debt.

- South African personal finance startup FinMeUp secured new funding in a round led by SAAD and Blu Sky Investments.

- Tuma, a fintech based in the Democratic Republic of Congo (DRC), locked in $500,000 in funding – the largest investment round for a Congelese fintech to date.