- Embedded finance company Finotta has teamed up with banking software provider ebankIT.

- The partnership will integrate Finotta’s Personified Personalized Financial Guidance platform with ebankIT’s digital banking solution.

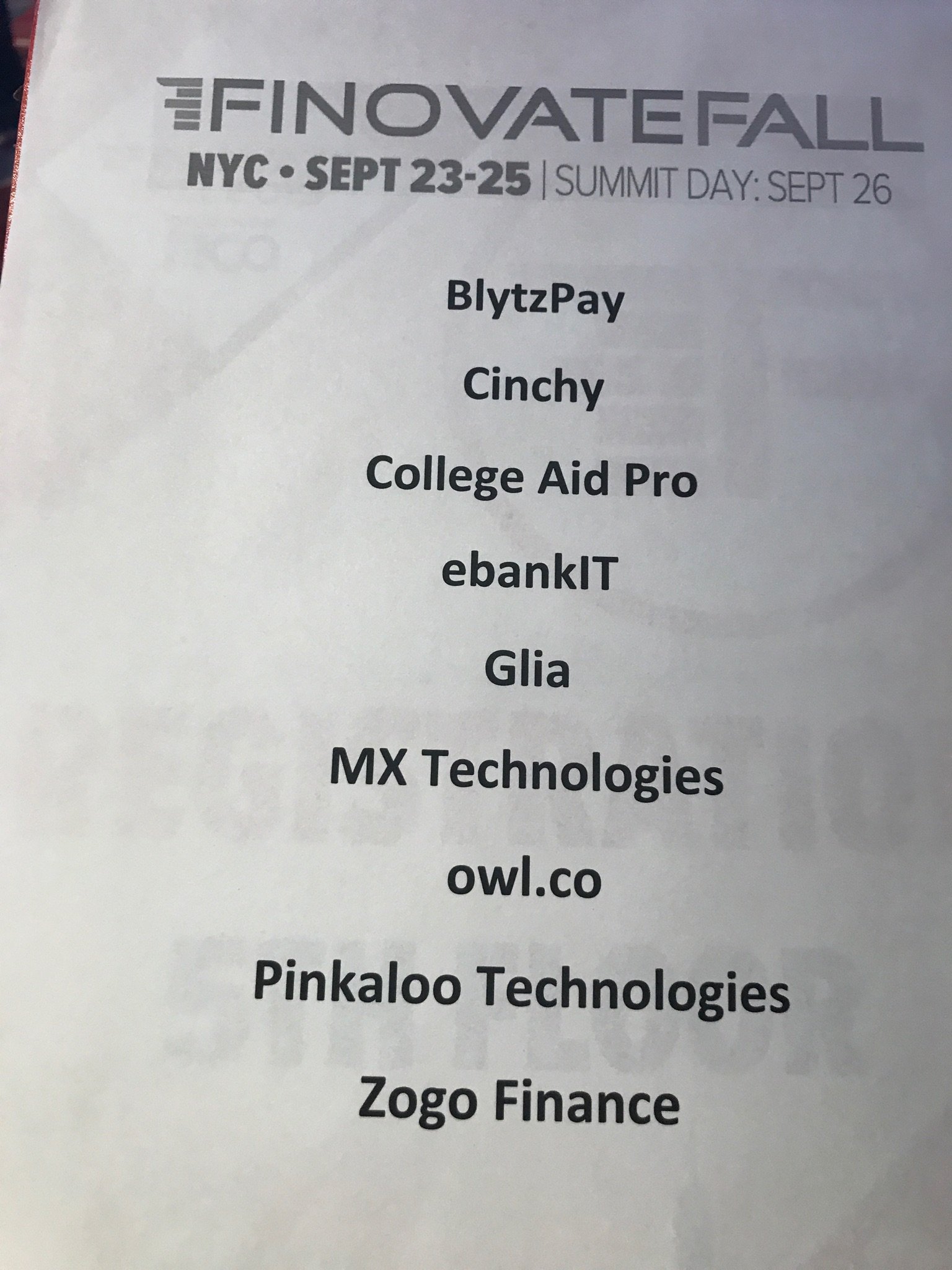

- Both Finotta and ebankIT are Finovate alums. ebankIT most recently demoed its technology at FinovateEurope in March. Finotta made its Finovate debut at FinovateFall 2022.

Embedded finance company Finotta has forged a new partnership with omnichannel banking software firm ebankIT. The partnership will integrate Finotta’s Personified platform with ebankIT’s digital banking solution in order to deliver better financial wellness tools and Personlized Financial Guidance (PFG) to customers worldwide.

Finotta’s Personified platform provides an automated and personalized mobile banking experience. Personified includes a financial coach, a financial health leveling system, automated financial guidance, predictive product referrals, digitized relationship building, the ability to make internal and external transfers, and more. The suite of solutions helps financial institutions address customer needs and respond to them from within the digital banking platform.

Personal finance is often treated as a local concern. However, Finotta founder and CEO Parker Graham put this week’s integration in an international context. “Financial wellness is a global imperative that transcends borders, affecting individuals and communities everywhere,” Graham said. “In partnering with ebankIT, we’re not just future-proofing financial institutions, we’re elevating the financial well-being of users and underscoring innovation as the bedrock of customer loyalty.”

ebankIT CEO Renato Oliveira said that delivering “humanized, personalized, and accessible digital experiences” is a priority for ebankIT “from day one.” He added, “At ebankIT, we recognize that the future of digital banking hinges on seamless omnichannel capabilities and enriched user experiences.” Oliveira called the partnership with Finotta “an extension of that commitment.”

Founded in 2014, ebankIT is headquartered in Portugal. The company has been a Finovate alum since winning Best of Show in its Finovate debut at FinovateEurope 2015. The company most recently demoed its technology at FinovateEurope earlier this year. At the conference, ebankIT introduced a new range of features on its digital banking platform. Among these features was a tool to help banks and credit unions better anticipate customer needs.

Over the summer, ebankIT announced a strategic partnership with digital transformation and cybersecurity consultancy, Online Business Systems. More recently, the company teamed up with Home Trust. Via the partnership, ebankIT helped the Canada-based mortgage broker launch its new digital banking platform.

Founded in 2018, Finotta is a newcomer to the Finovate stage. The Overland Park, Kansas-based company made its debut last year at FinovateFall 2022. Finotta announced in August that its Personified platform increased user engagement to an average of 13 minutes per month. Graham credited the difference between Finotta’s Personalized Financial Guidance platform and traditional personal finance management solutions.

“To better capitalize on existing digital banking investments and increase share of wallet all while lowering acquisition costs, banks need to shift their focus away from PFMs and instead embrace Personalized Financial Guidance,” Graham said. “By focusing on guiding customers through their financial journey, they increase the amount of time users spend in the app.”